When JPMorgan Chase COO Daniel Pinto recently expressed "concerns" about private credit providers serving small businesses, his timing was telling. Private credit has grown to an estimated $2 trillion market, finally bringing capital to businesses that traditional banks have long overlooked. Only now, as this market threatens big banks' dominance, do we hear calls for increased scrutiny.

Let's be clear about why this market exists: big banks have systematically retreated from small business lending over the past two decades. Their standardized approach to credit evaluation and high costs of servicing smaller accounts made these relationships unprofitable by their standards. The average small business loan application costs a bank nearly as much to process as a large one, but generates far less revenue. Rather than innovate to serve these customers more efficiently, most banks simply stopped serving them.

Critics often point to the higher interest rates charged by private lenders as evidence of predatory practices. But this simplistic view ignores the realities of serving this market. Yes, private credit is more expensive than traditional bank loans – it has to be. These lenders take on borrowers that banks won't touch, invest heavily in customer education and support, and develop innovative ways to evaluate creditworthiness. Their higher rates reflect these costs and risks, not excessive profits. In fact, JPMorgan Chase's profit margins often exceed those of private lenders, despite charging lower interest rates on their loans.

The Risk of Misguided Regulation

Pinto's comments seem designed to invite regulatory intervention, but poorly designed regulations could devastate small business access to capital. We've seen this before. After the 2008 financial crisis, increased banking regulations made small business lending even less attractive to banks. The market gap this created helped spark the fintech revolution in lending.

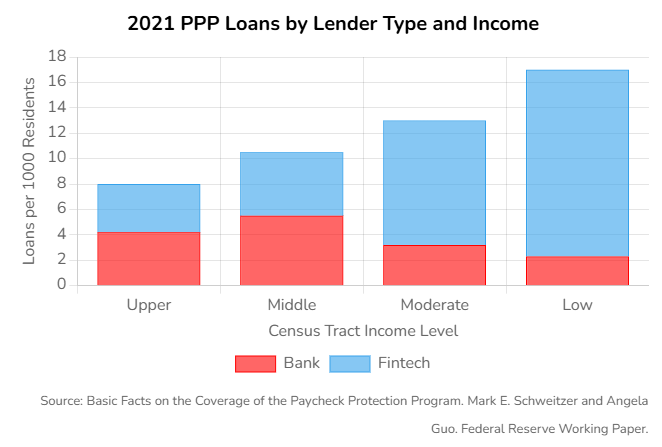

During the pandemic, fintech and alternative lenders proved crucial in delivering PPP loans to the smallest businesses, particularly in underserved communities. While traditional banks initially focused on their largest customers, fintech lenders provided over 80% of PPP loans in minority communities. These lenders have continued to serve businesses that might otherwise have no access to capital.

The PPP data tells a compelling story. Like the other fintechs in 2020, my business, ForwardLine, was locked out of round one of PPP lending. A study by the Cleveland fed shows that when the fintechs were let in for round two in 2021, they got more loans to more businesses, and in the areas of most need.

Regulations that arbitrarily cap interest rates or restrict lending structures might sound consumer-friendly, but they would likely push many lenders out of the market entirely. This wouldn't make loans cheaper – it would make them unavailable to many businesses that need them. The result? More small businesses would be forced to rely on merchant cash advances, personal credit cards, or other even more expensive options.

Building Better Standards

Instead of restrictive regulations, what the market needs is better standardization and transparency. The mortgage industry shows how this can work. By developing clear standards for underwriting, documentation, and securitization, mortgages became more accessible while giving investors confidence to provide capital at scale.

Small business lending is more complex than mortgages, but similar principles could apply. With advances in open banking and cash flow analytics, we could develop standardized SMB credit scores – not to dictate lending decisions, but to give investors consistent ways to evaluate loan portfolios. We could establish common frameworks for loan terms, servicing standards, and collection practices. Most importantly, we could simplify and standardize how terms are presented to borrowers, bringing much-needed transparency to the market.

The goal isn't to make all small business loans identical – that would stifle the innovation that's finally bringing capital to underserved businesses. Instead, we need standards that help both borrowers and investors better understand and compare their options. This would strengthen the market while preserving the flexibility that makes alternative lenders so valuable.

Better standards would also address many of the legitimate concerns about market stability that Pinto raises. Standardized reporting and performance metrics would help investors better understand and price risk. Common servicing standards would ensure consistent treatment of borrowers during economic downturns. Transparency in pricing and terms would help borrowers make better decisions about taking on debt.

The future of small business lending isn't in protecting big banks' traditional advantages – it's in creating transparent, efficient markets that serve businesses of all sizes. That requires embracing innovation while building standards that help this growing market mature responsibly. Small businesses deserve more options for accessing capital, not fewer.

When big banks raise alarms about new competitors, we should remember their decades-long retreat from small business lending. Instead of letting their concerns drive us toward restrictive regulation, let's push for standards that make this vital market work better for everyone.